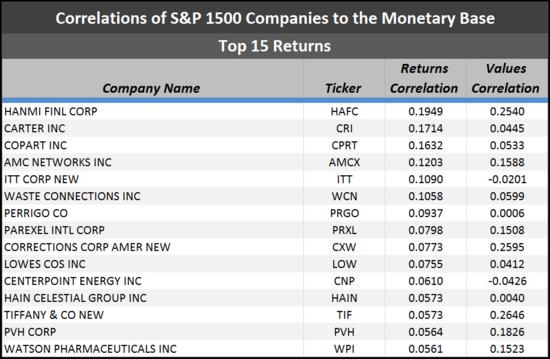

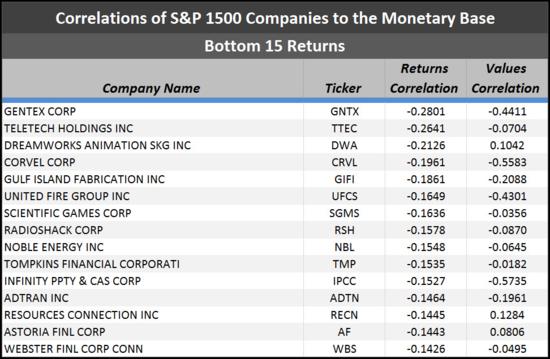

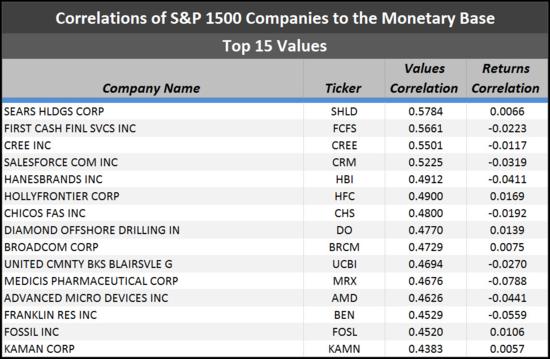

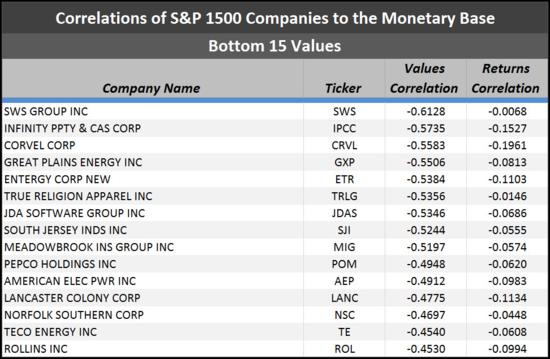

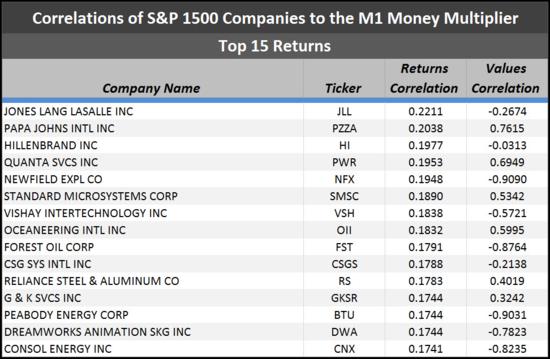

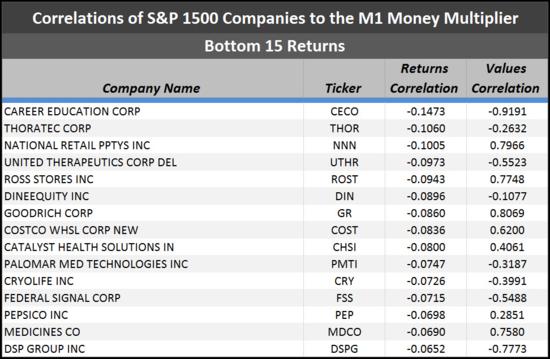

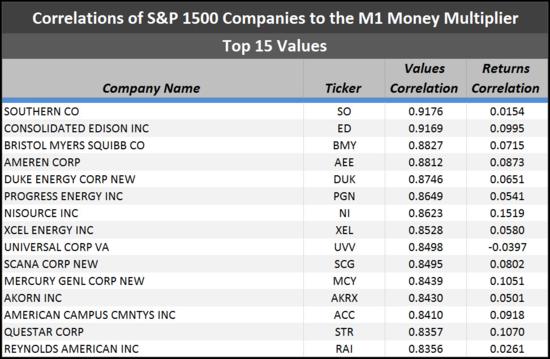

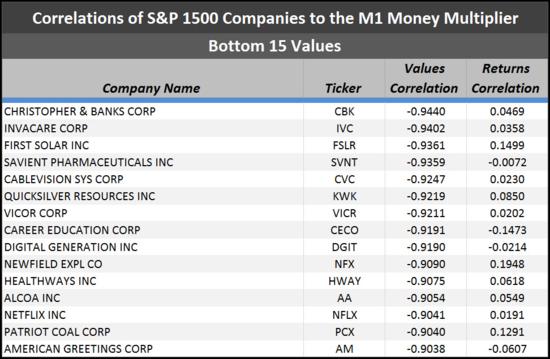

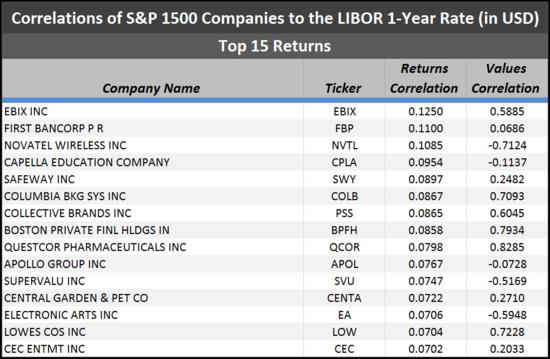

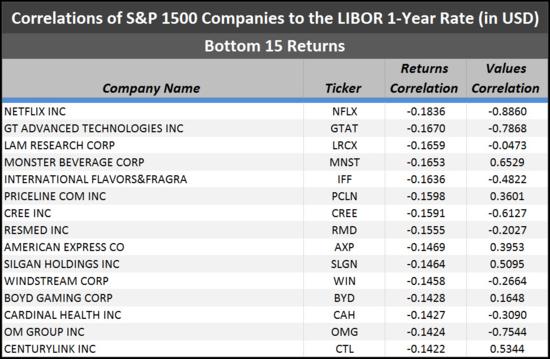

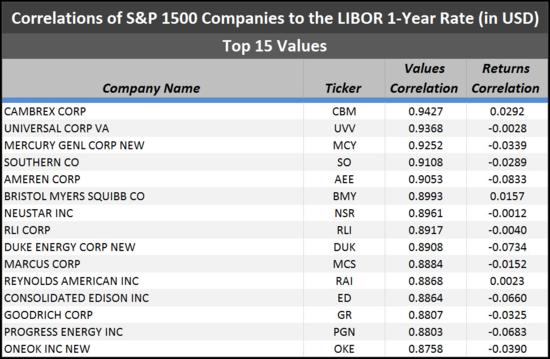

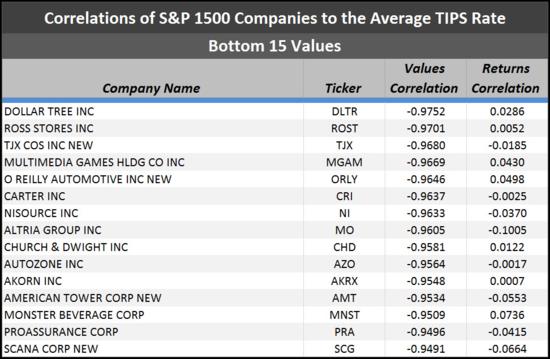

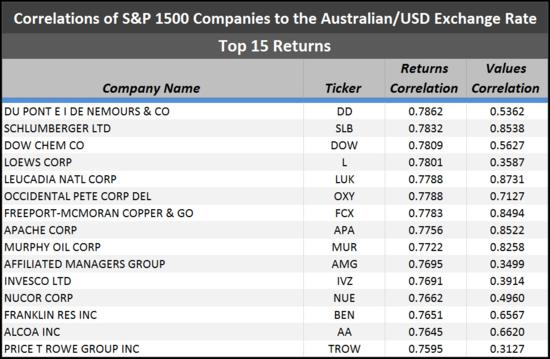

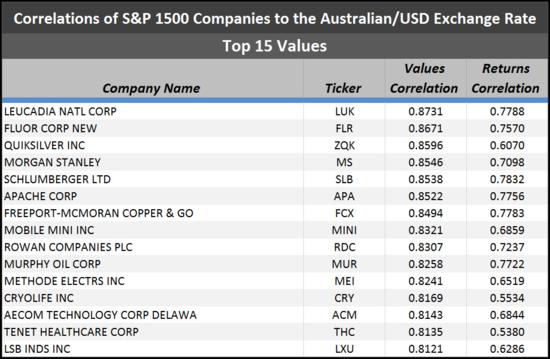

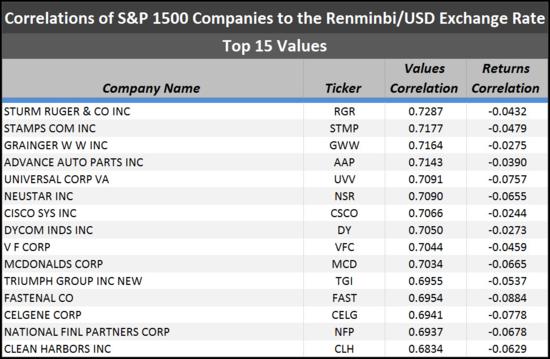

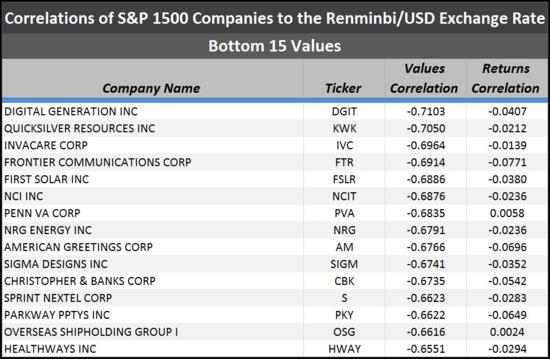

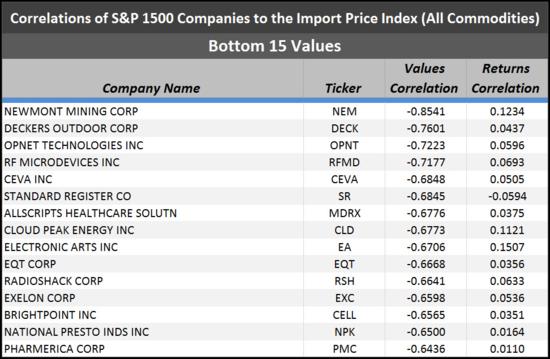

Correlations of the S&P 1500-based Returns and ValuesThe following tables list the S&P 1500 stocks with the highest and lowest correlations for each respective macroeconomic factor. The tables include correlations of returns, which illustrate short-term information, as well as correlations of values, which capture longer term trends.Correlations of the S&P 1500-based Returns and Values to: (1) Monetary Base; (2) M1 Money Multiplier; (3) LIBOR 1-Year Rate (in USD); (4) Average TIPS Rate (5) Euro/USD Exchange Rate; (6) Australian/USD Exchange Rate; (7) Chinese Renminbi/USD Exchange Rate; (8) Import Price Index (All Commodities) Updated: July 2012 Source: MacroRisk Analytics |

Central Banks: Home Correlations: ETF-based Returns & Values Correlations: MSCI Global Indexes-based Returns & Values QuickResponse™ Portfolios InterActive: Home |

| CORRELATIONS TO THE MONETARY BASE | ||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE M1 MONEY MULTIPLIER |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE LIBOR 1-YEAR RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE AVERAGE TIPS RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE EURO/U.S.DOLLAR EXCHANGE RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE AUSTRALIAN/U.S. DOLLAR EXCHANGE RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE CHINESE RENMINBI/USD EXCHANGE RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE IMPORT PRICE INDEX - ALL COMMODITIES |

||

|

|

|

|

|

|

| Top of Page |

||