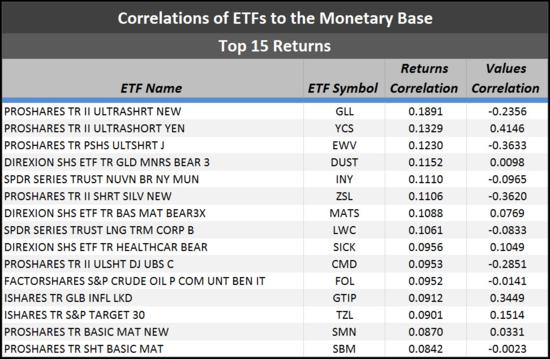

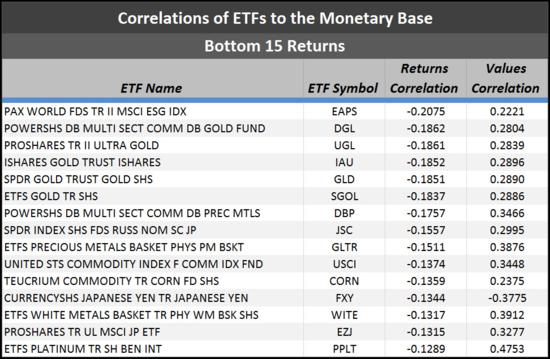

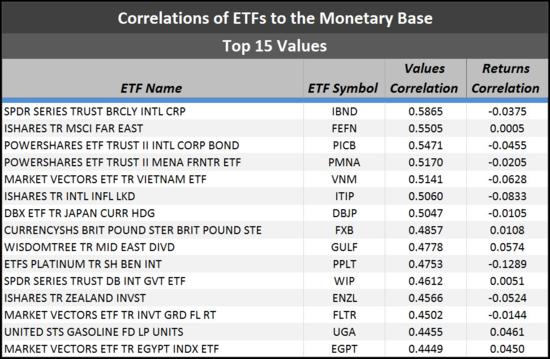

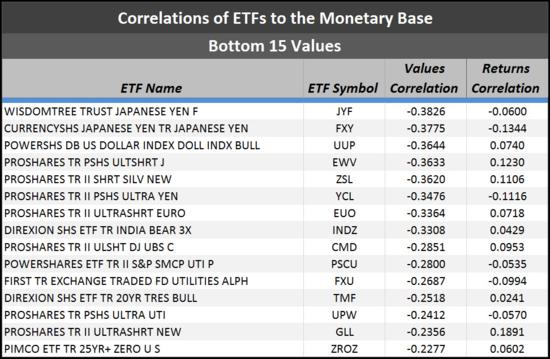

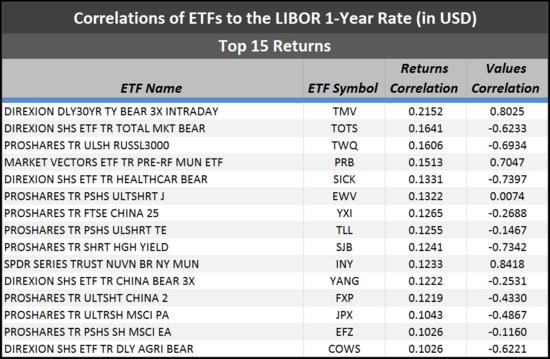

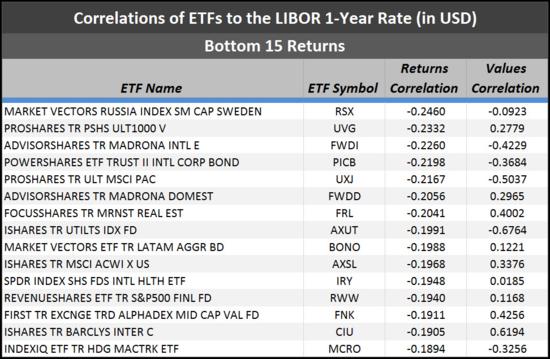

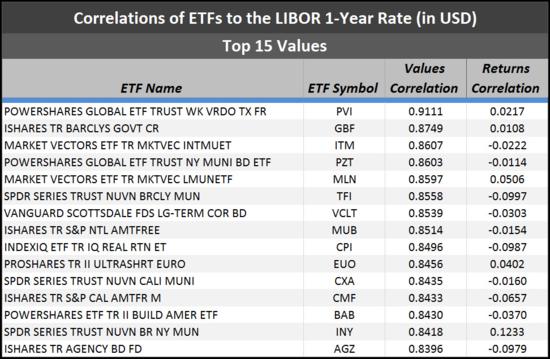

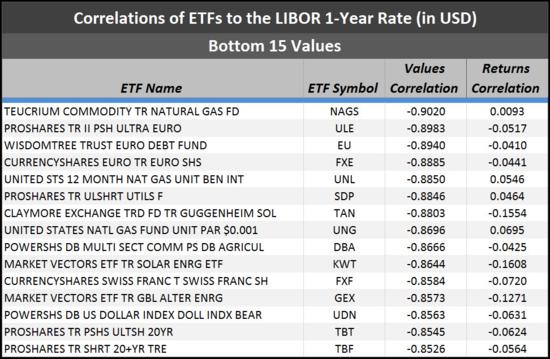

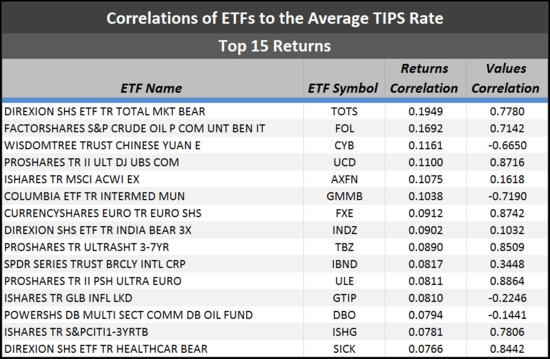

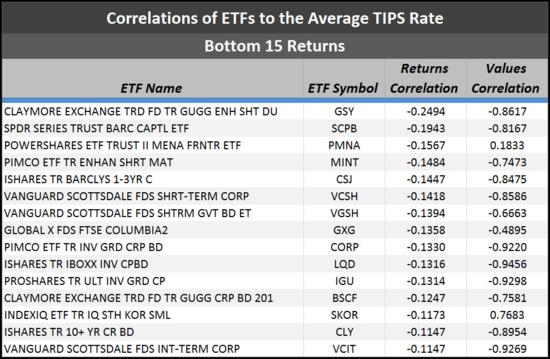

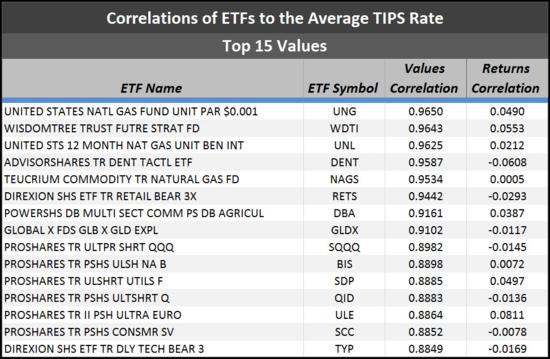

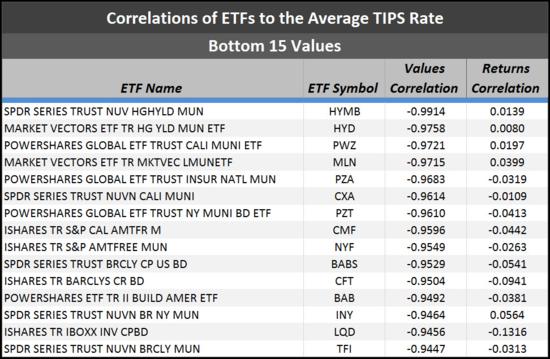

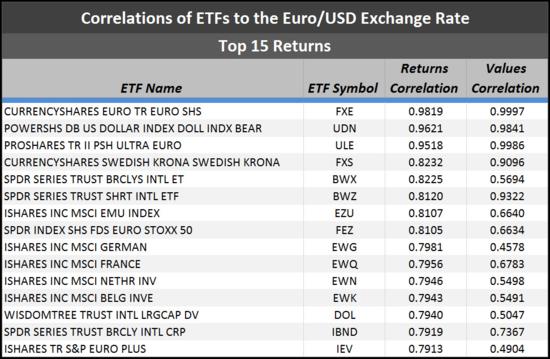

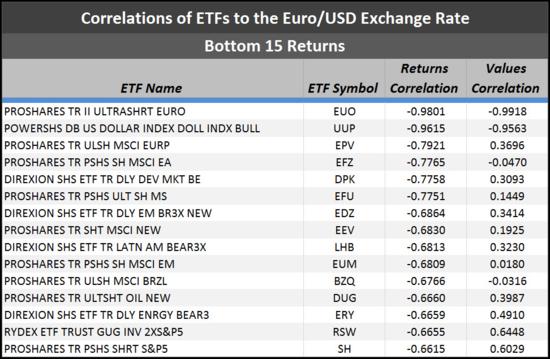

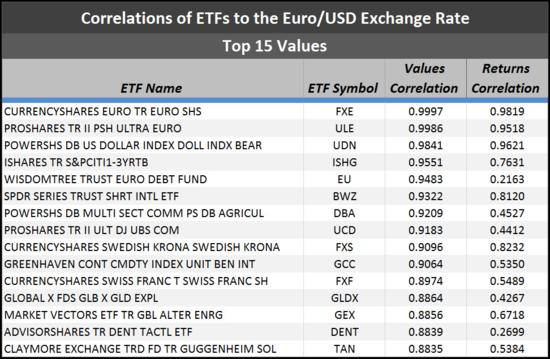

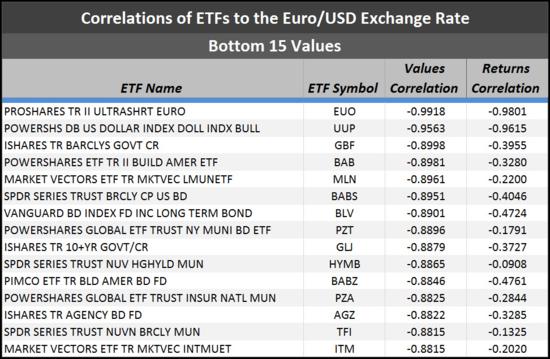

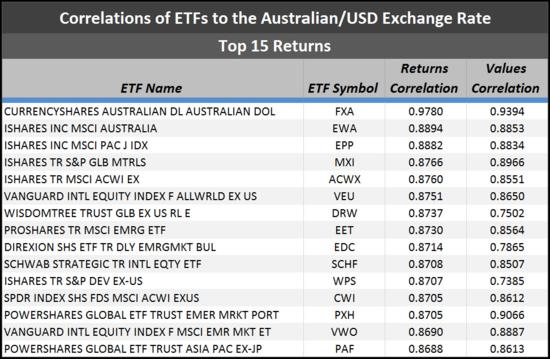

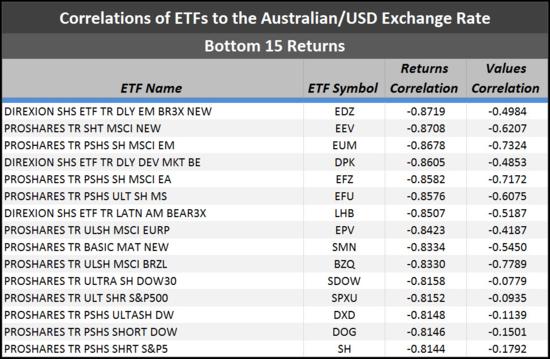

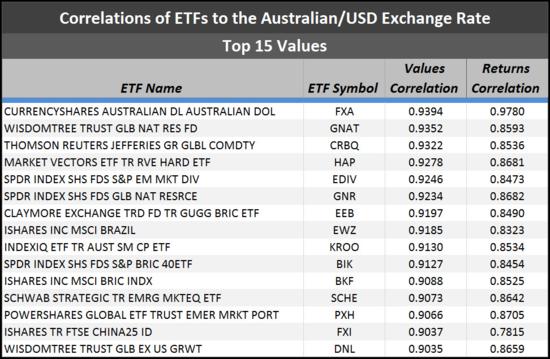

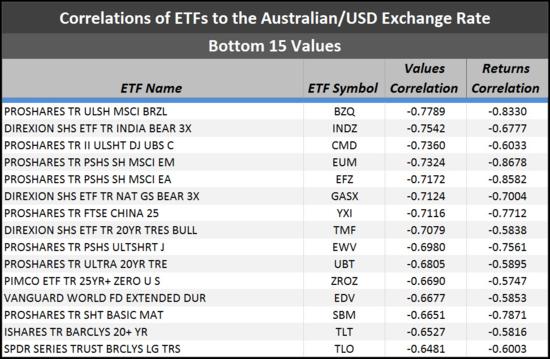

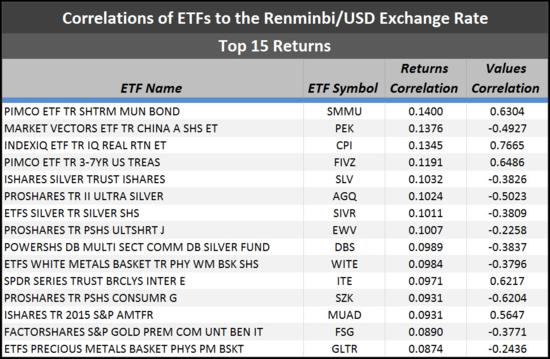

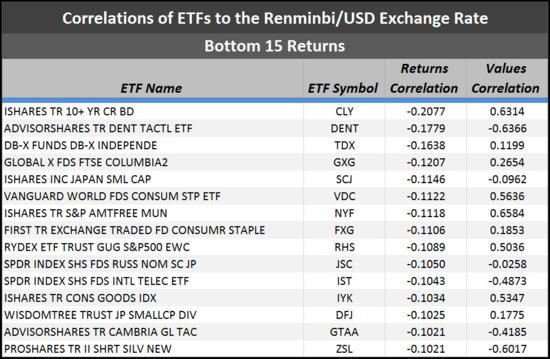

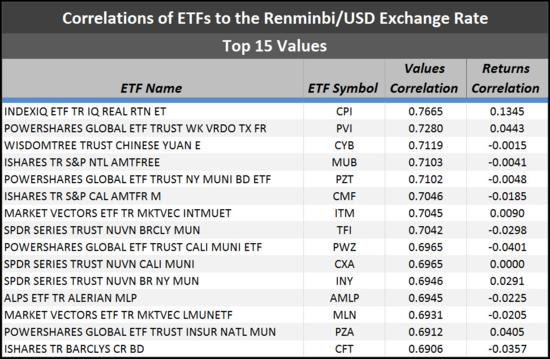

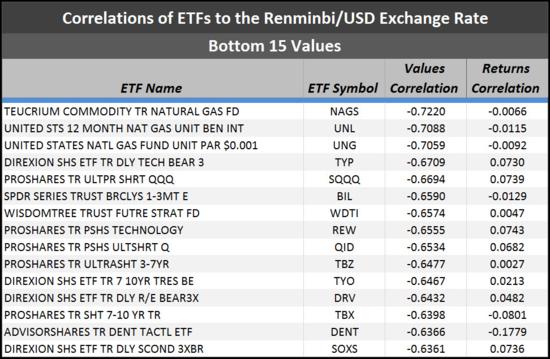

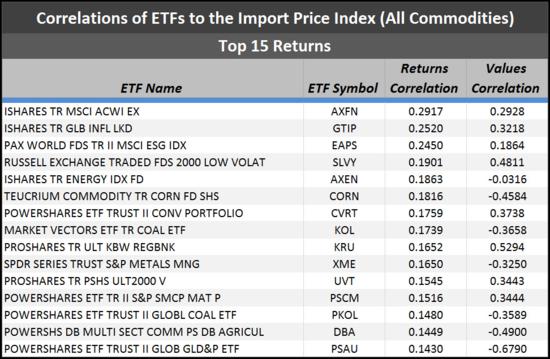

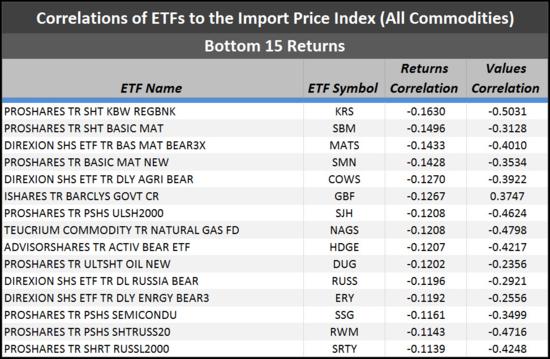

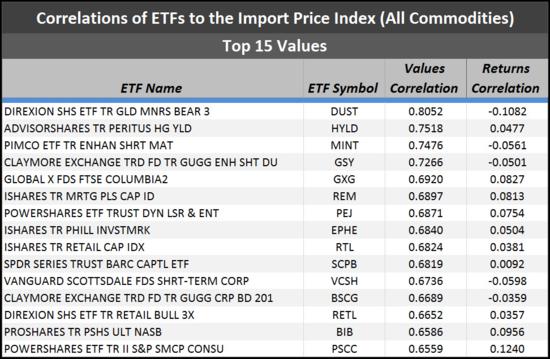

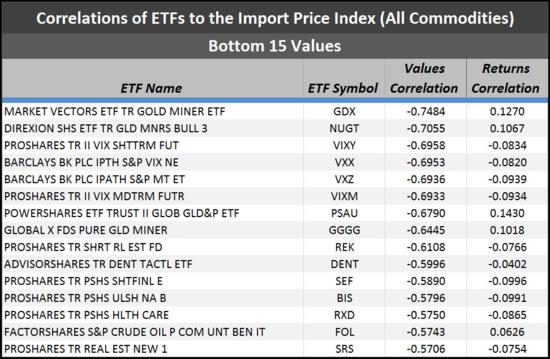

Correlations of ETF-based Returns and Values for Central BanksThe following tables list the ETFs with the highest and lowest correlations for each respective macroeconomic factor. The tables include correlations of returns, which illustrate short-term information, as well as correlations of values, which capture longer term trends.Correlations of ETF-based Returns and Values to: (1) Monetary Base; (2) M1 Money Multiplier; (3) LIBOR 1-Year Rate (in USD); (4) Average TIPS Rate (5) Euro/USD Exchange Rate; (6) Australian/USD Exchange Rate; (7) Chinese Renminbi/USD Exchange Rate; (8) Import Price Index (All Commodities) Updated: July 2012 Source: MacroRisk Analytics |

Central Banks: Home Correlations: S&P 1500-based Returns & Values Correlations: MSCI Global Indexes-based Returns & Values QuickResponse™ Portfolios InterActive: Home |

| CORRELATIONS TO THE MONETARY BASE | ||

|

|

|

|

|

|

| Top of Page |

||

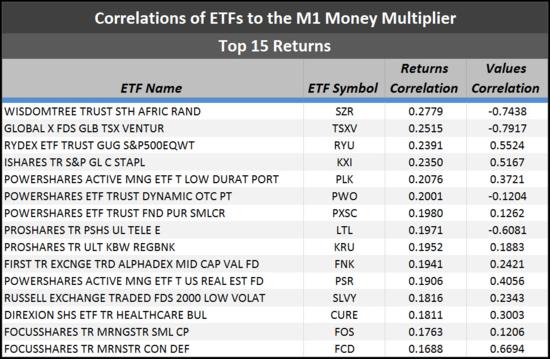

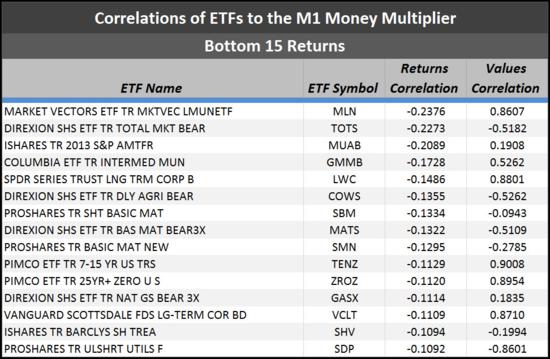

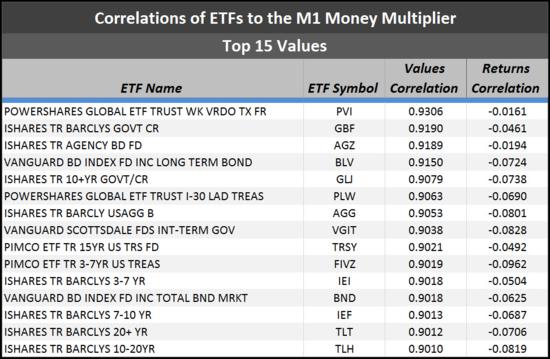

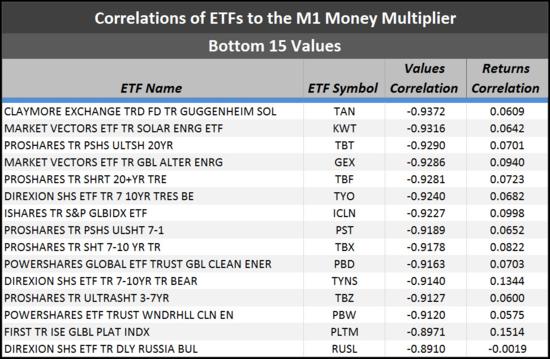

| CORRELATIONS TO THE M1 MONEY MULTIPLIER |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE LIBOR 1-YEAR RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE AVERAGE TIPS RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE EURO/U.S.DOLLAR EXCHANGE RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE AUSTRALIAN/U.S. DOLLAR EXCHANGE RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE CHINESE RENMINBI/USD EXCHANGE RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE IMPORT PRICE INDEX - ALL COMMODITIES |

||

|

|

|

|

|

|

| Top of Page |

||