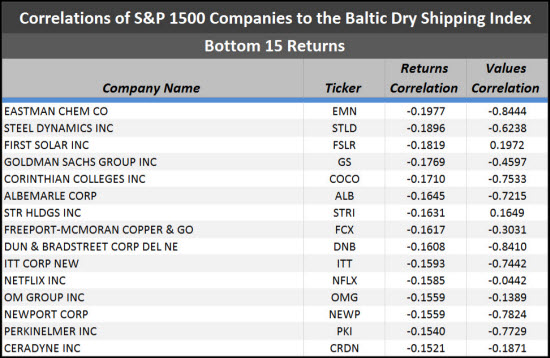

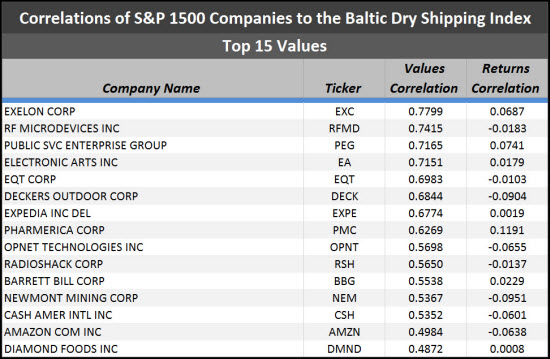

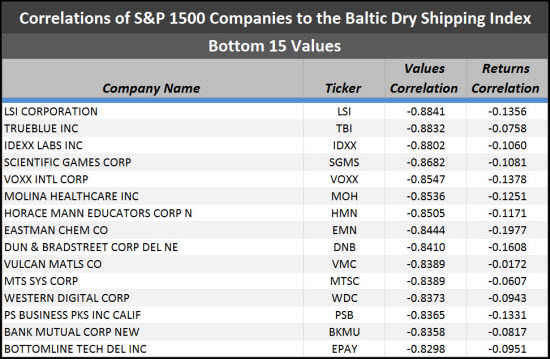

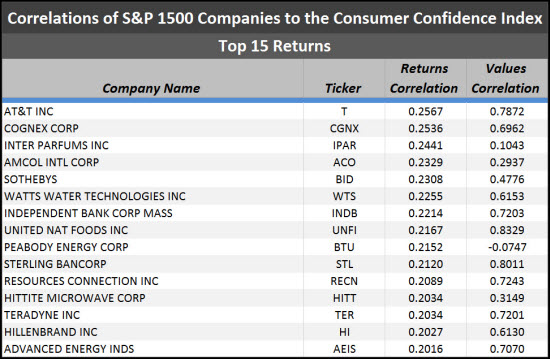

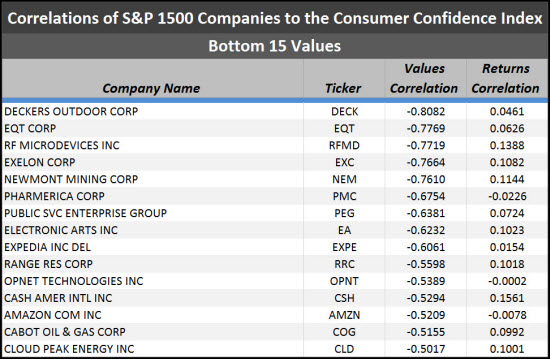

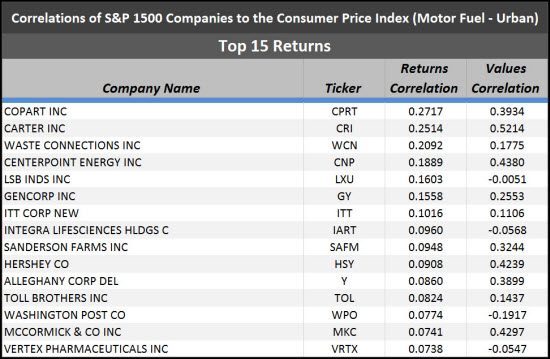

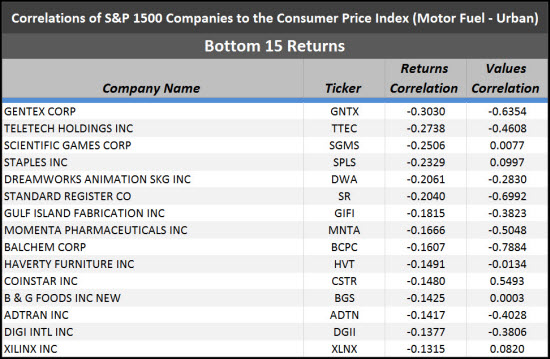

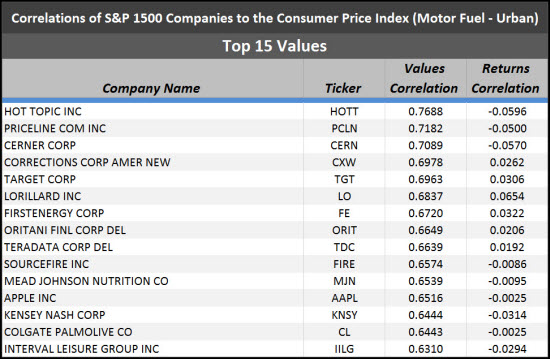

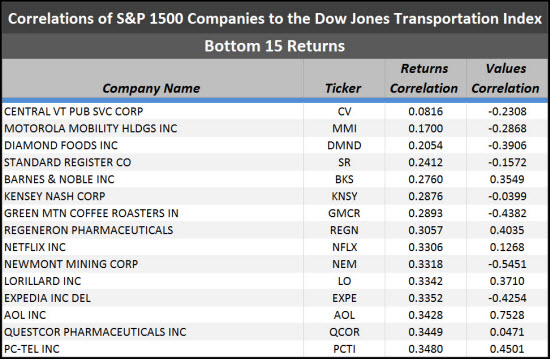

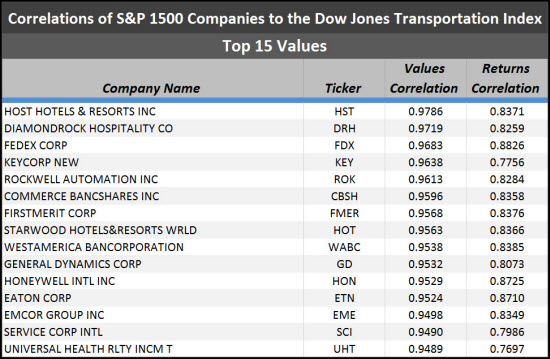

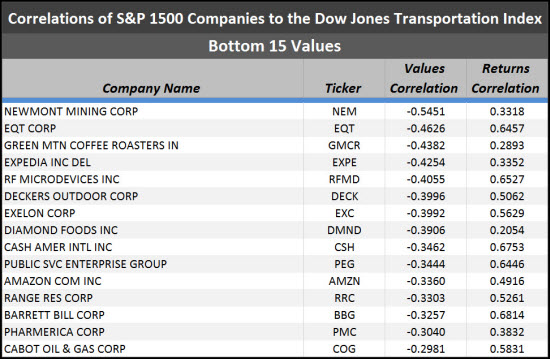

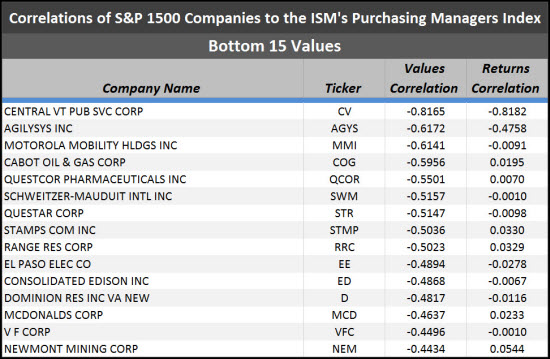

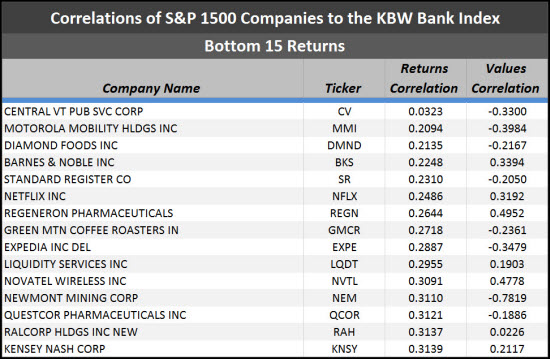

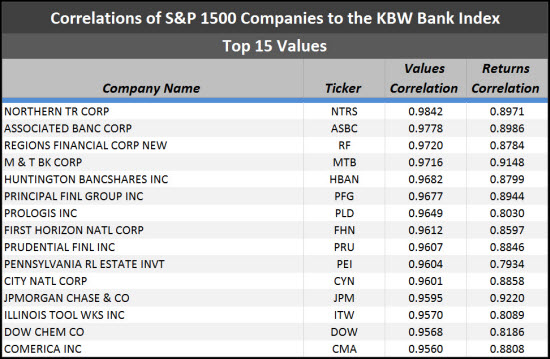

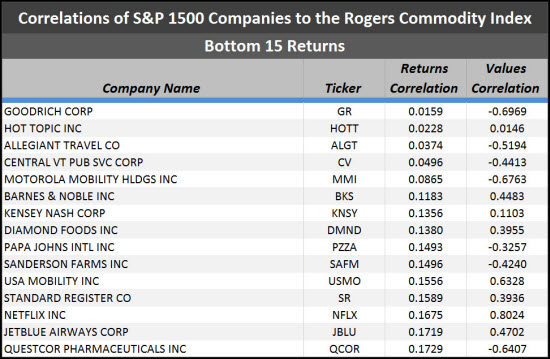

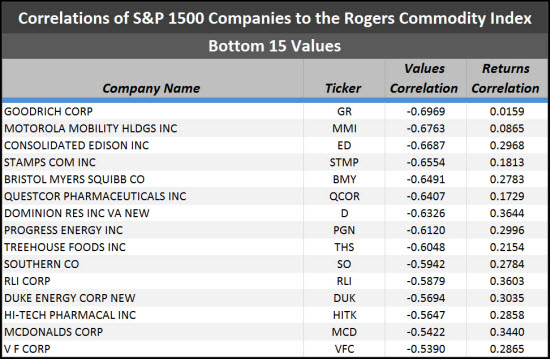

Correlations of the S&P 1500-based Returns and ValuesThe following tables list the S&P 1500 stocks with the highest and lowest correlations for each respective macroeconomic factor. The tables include correlations of returns, which illustrate short-term information, as well as correlations of values, which capture longer term trends.Correlations of the S&P 1500 Index-based Returns and Values to: (1) Baltic Dry Shipping Index (2) Consumer Confidence Index (3) Consumer Price Index (Fuel) (4) Dow Jones Transportation Index (5) Euro/U.S. Dollar Exchange Rate (6) ISM Purchasing Index (7) KBW Bank Index (8) Rogers Commodity Index (9) S&P 500 Index (10) VIX (Market Volatility Index) Updated: July 2012 Source: MacroRisk Analytics |

Global Oil: Home Global Oil: Correlations--ETF-based Returns and Values Global Oil: Correlations--Global-based Returns and Values QuickResponse™ Portfolios InterActive: Home |

| CORRELATIONS TO THE BALTIC DRY SHIPPING INDEX | ||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE CONSUMER CONFIDENCE INDEX |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE CONSUMER PRICE INDEX (FUEL - URBAN) |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE DOW JONES TRANSPORTATION INDEX |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE EURO/U.S.DOLLAR EXCHANGE RATE |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE ISM PURCHASING MANAGERS INDEX |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE KBW BANK INDEX |

||

|

|

|

|

|

|

| Top of Page |

||

| CORRELATIONS TO THE ROGERS INTERNATIONAL COMMODITY INDEX |

||

|

|

|

|

|

|

| Top of Page |

||

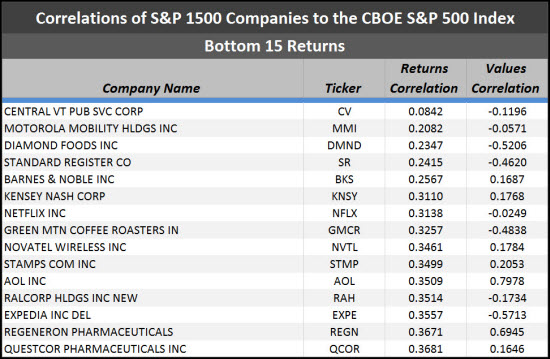

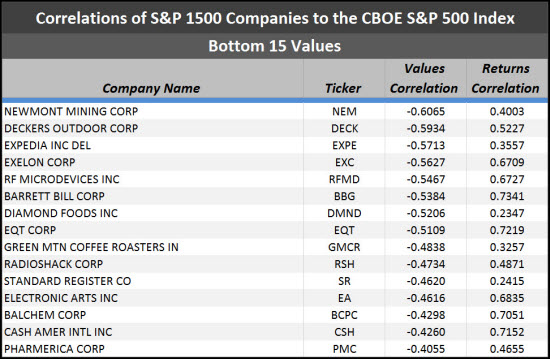

| CORRELATIONS TO THE S&P 500 INDEX |

||

|

|

|

|

|

|

| Top of Page |

||

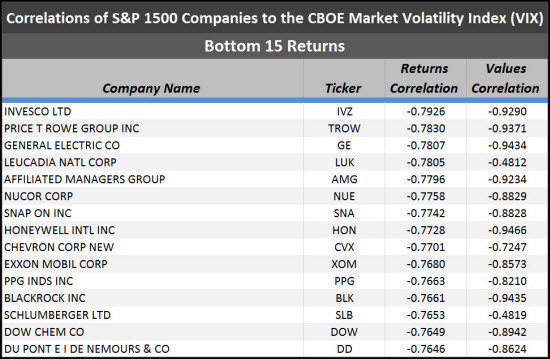

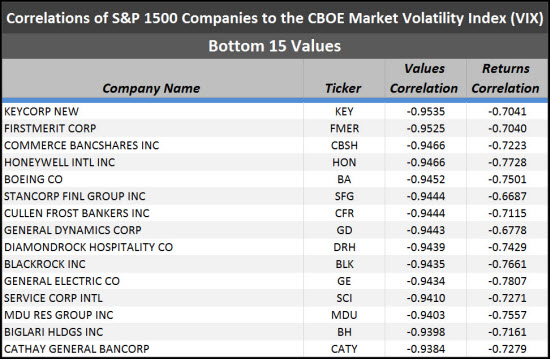

| CORRELATIONS TO THE VIX - MARKET VOLATILITY INDEX |

||

|

|

|

|

|

|

| Top of Page |

||